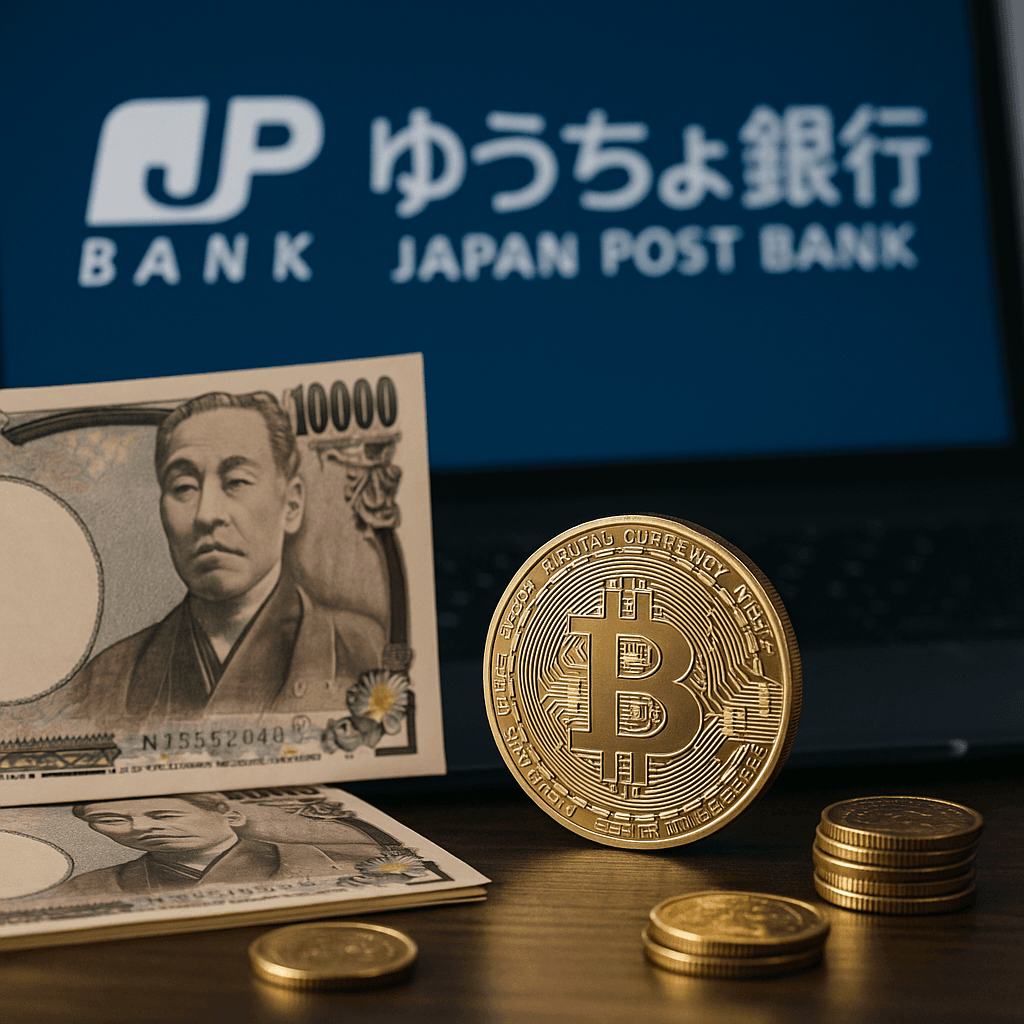

Japan Post Bank, managing $1.3 trillion in deposits, is set to launch a transformative tokenized asset network using DCJPY, a yen-backed digital currency, by fiscal year 2026. With 120 million account holders, this initiative aims to modernize securities trading and digitize financial operations, positioning Japan as a Web3 leader. Developed by DeCurret DCP, DCJPY promises near-instant settlements and innovative applications. This article explores the network’s features, impact, and future in Japan’s digital finance landscape.

DCJPY: A Yen-Backed Digital Revolution

DCJPY is a tokenized deposit currency, pegged 1:1 to the Japanese yen, operating on a permissioned blockchain by DeCurret DCP. Unlike stablecoins, it represents direct bank deposits, ensuring regulatory compliance and deposit insurance. By 2026, Japan Post Bank’s customers can convert savings into DCJPY via an app, enabling seamless purchases of tokenized securities, such as bonds and real estate, with potential 3–5% returns. This move aims to activate ¥190 trillion in dormant savings, boosting market liquidity.

Transforming Securities and Government Operations

The DCJPY network will slash settlement times from days to seconds, reducing costs and enhancing efficiency for securities transactions. Pilot tests, including ¥2 billion in simulated settlements, confirm its scalability. Beyond finance, DCJPY could digitize government operations, with DeCurret DCP in talks to distribute subsidies and grants, streamlining administrative processes. This aligns with Japan’s proactive blockchain regulations, fostering innovation in Web3 applications like NFTs and digital securities.

Challenges and Strategic Importance

Despite its promise, DCJPY faces hurdles. Its permissioned blockchain limits access to approved institutions, potentially hindering broader retail adoption compared to open stablecoins like JPYC. Regulatory complexities and cybersecurity risks also loom, requiring robust infrastructure. However, Japan Post Bank’s scale—holding more deposits than JPMorgan Chase—positions it to drive Web3 adoption, potentially influencing global tokenized asset markets projected to reach $18.9 trillion by 2033.

Conclusion: A Bold Step Toward Web3

Japan Post Bank’s DCJPY initiative marks a pivotal shift in digital finance, blending traditional banking with blockchain innovation. By enabling instant settlements and digitizing assets, it could redefine Japan’s financial landscape and inspire global adoption. As Web3 grows, DCJPY’s launch in 2026 is a must-watch for investors and institutions eager to capitalize on the $18.9 trillion tokenized asset market.