In the fast-evolving world of Web3, few terms are mentioned as often as “Layer-1 blockchain.” From Bitcoin to Ethereum and beyond, Layer-1s form the bedrock of decentralized networks, powering everything from DeFi applications to NFT marketplaces. Yet for many, the concept remains murky. What exactly is a Layer-1 blockchain, and why does it matter in the future of digital finance?

This article breaks down the essentials of Layer-1 blockchains, their key functions, benefits, and examples, helping you understand why they’re at the heart of the Web3 revolution.

What Is a Layer-1 Blockchain?

A Layer-1 blockchain is the base network that processes and records transactions directly on its distributed ledger. Unlike “Layer-2” solutions—which are built on top of Layer-1s to improve speed or scalability—Layer-1s provide the fundamental security, consensus mechanisms, and rules of the system.

Think of it as the foundation of a skyscraper: everything else is built on top of it, but the core structure determines the stability, capacity, and safety of the entire system.

Examples of popular Layer-1 blockchains include:

- Bitcoin (BTC): The original decentralized currency, focused on peer-to-peer value transfer.

- Ethereum (ETH): A programmable blockchain supporting smart contracts and decentralized applications (dApps).

- Solana, Avalanche, and HyperLiquid: Newer entrants optimizing for high speed and low fees.

How Do Layer-1 Blockchains Work?

At their core, Layer-1 blockchains manage three crucial aspects:

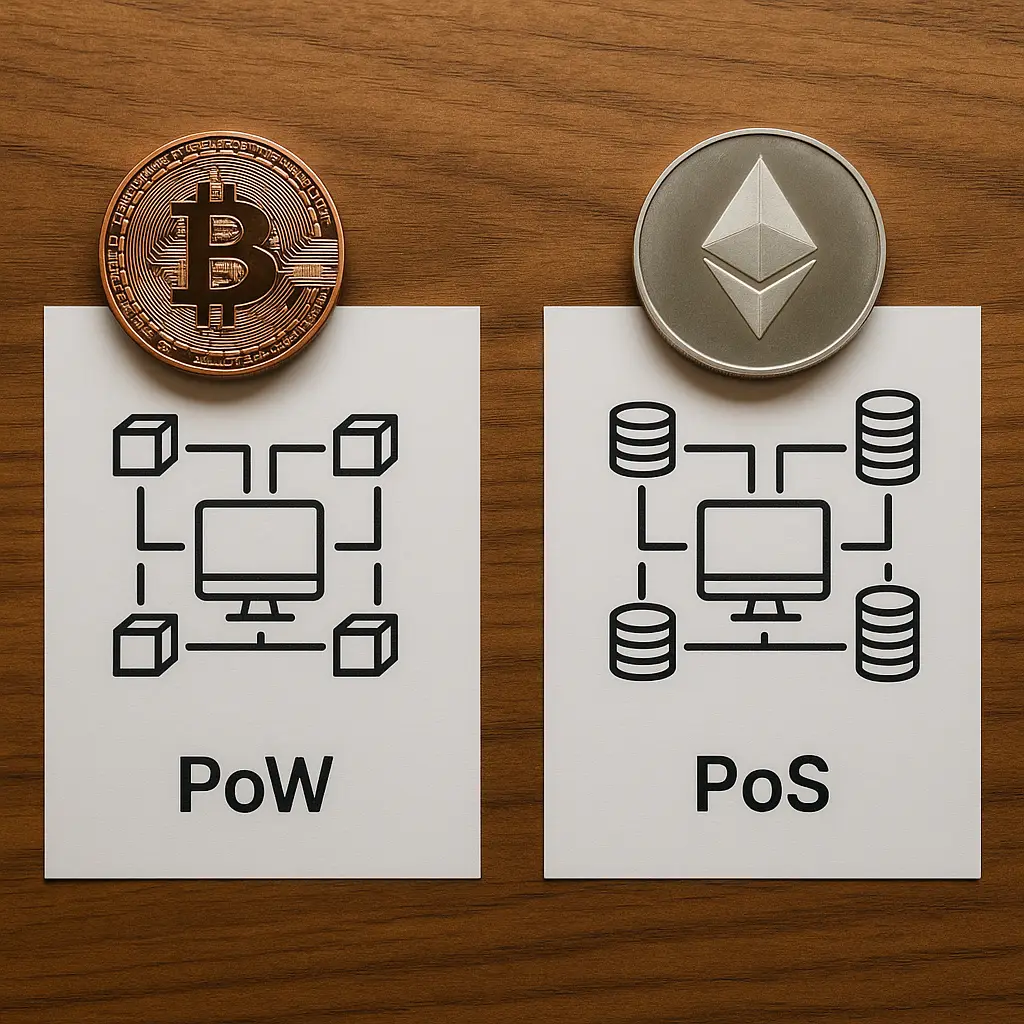

- Consensus Mechanisms

They ensure all participants agree on the state of the ledger. Bitcoin uses Proof-of-Work (PoW), while Ethereum and many newer blockchains use Proof-of-Stake (PoS) for efficiency. - Security & Decentralization

Because data is spread across thousands of nodes globally, Layer-1 blockchains remain resistant to censorship, tampering, or centralized control. - Native Tokens

Each Layer-1 has its own token (e.g., BTC, ETH, SOL) that powers the ecosystem, rewards validators, and enables transactions.

Benefits and Challenges of Layer-1s

Benefits:

- Security: Direct control over the base layer makes these blockchains highly secure.

- Decentralization: Reduces reliance on centralized servers or intermediaries.

- Programmability: Many Layer-1s enable developers to create dApps, DAOs, and NFTs.

Challenges:

- Scalability Issues: Processing every transaction on the base layer can slow networks down.

- High Costs: Transaction fees can spike during peak demand (e.g., Ethereum gas fees).

- Complex Upgrades: Major changes often require forks or protocol-wide upgrades.

Why Layer-1 Blockchains Matter for the Future of Web3

Without strong Layer-1 blockchains, the Web3 ecosystem would collapse. They provide the trustless environment where innovation thrives—allowing DeFi platforms to replace banks, NFTs to revolutionize ownership, and decentralized social networks to challenge Big Tech monopolies.

As new projects like HyperLiquid, Aptos, and Sui experiment with higher throughput and faster consensus, Layer-1s continue to evolve, addressing old bottlenecks while unlocking new possibilities for mainstream adoption.

Conclusion

Layer-1 blockchains are more than just technology—they are the foundation of the decentralized internet. By securing transactions, enabling smart contracts, and powering entire ecosystems, they pave the way for Web3’s most ambitious innovations. Whether you’re an investor, developer, or curious newcomer, understanding Layer-1s is essential to grasping the future of digital finance.