REAL, a Layer 1 blockchain, is poised to revolutionize real-world asset (RWA) tokenization, targeting a $30 trillion market by 2034. With $500 million in assets already primed for tokenization. REAL’s innovative approach integrates business validators and a Disaster Recovery Fund (DRF) to ensure security and trust. This article explores how REAL is transforming finance, its unique features, and its potential to bridge traditional and decentralized economies.

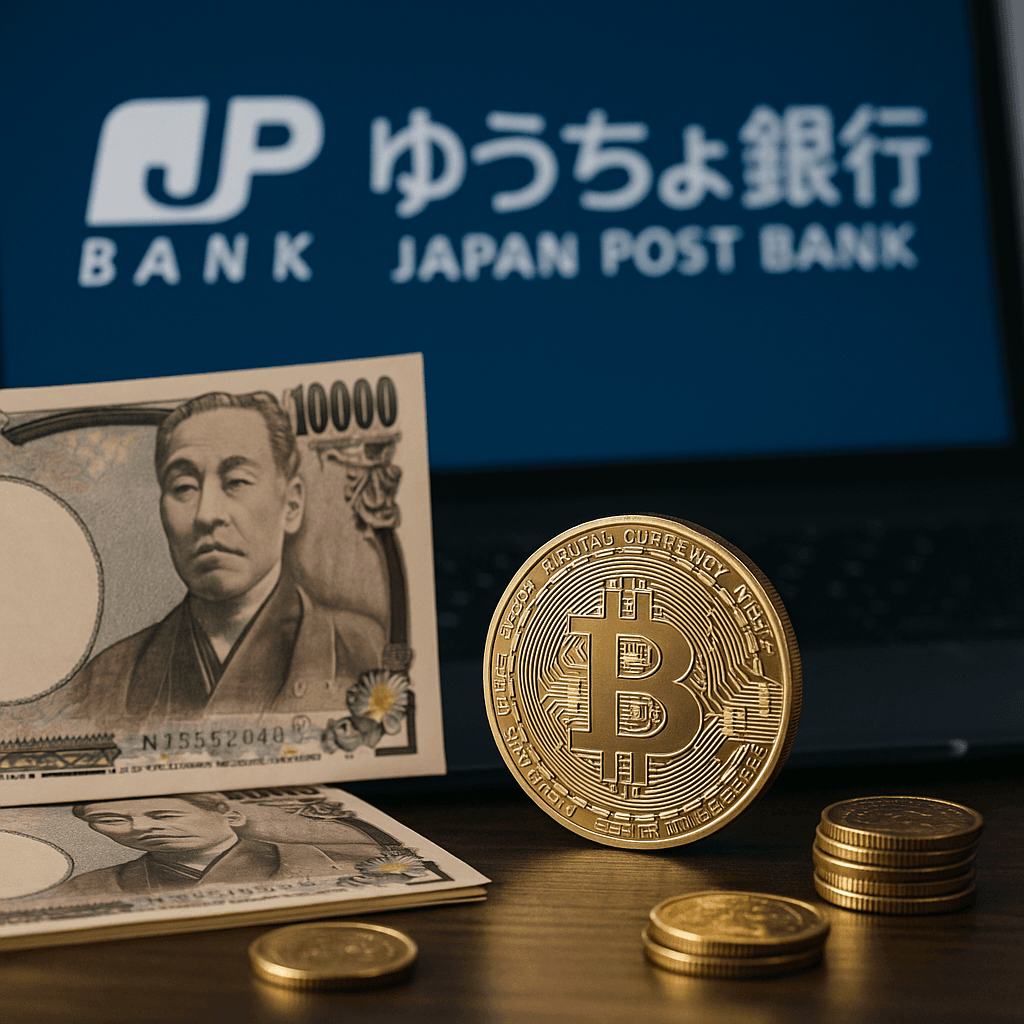

REAL’s Vision: Tokenizing Real-World Assets

REAL is the first Layer 1 blockchain dedicated to RWA tokenization, converting assets like real estate, bonds, and commodities into digital tokens. Unlike general-purpose blockchains, REAL’s architecture is tailored for institutional adoption, enabling seamless integration with DeFi protocols. With partnerships like Wiener Privatbank. REAL has tokenized $500 million in assets, aiming to capture a slice of the projected $30 trillion RWA market. Its compliance-first approach ensures regulatory alignment across jurisdictions, making it a trusted platform for banks and asset managers.

Innovative Features: Business Validators and DRF

REAL’s dual validator architecture sets it apart, embedding business validators into its consensus mechanism for enhanced security and trust. This contrasts with external smart contract models, offering native integration for efficiency. The Disaster Recovery Fund (DRF), a non-inflationary reserve, protects investors and issuers by compensating for adverse events. These features make REAL a safer, more reliable ecosystem compared to traditional DeFi platforms.

Impact on Finance: Bridging TradFi and DeFi

By tokenizing assets, REAL unlocks liquidity and accessibility, allowing fractional ownership and 24/7 trading. For instance, BlackRock’s tokenized fund OUSG, integrated into DeFi, showcases how RWAs enhance collateral use and market efficiency. REAL’s partnerships with financial giants enable banks to tokenize fixed-income products without deep blockchain expertise, fostering mass adoption. This convergence of traditional finance (TradFi) and DeFi positions REAL as a leader in reshaping global markets.

Conclusion: A New Era for Asset Tokenization

REAL’s Layer 1 blockchain is more than a platform. It’s a catalyst for a $30 trillion transformation in real-world asset tokenization. By prioritizing security, compliance, and innovation, REAL is bridging the gap between TradFi and DeFi, unlocking unprecedented opportunities for investors. As Web3 adoption accelerates, REAL’s vision could redefine how we interact with assets, making it a must-watch in 2025.