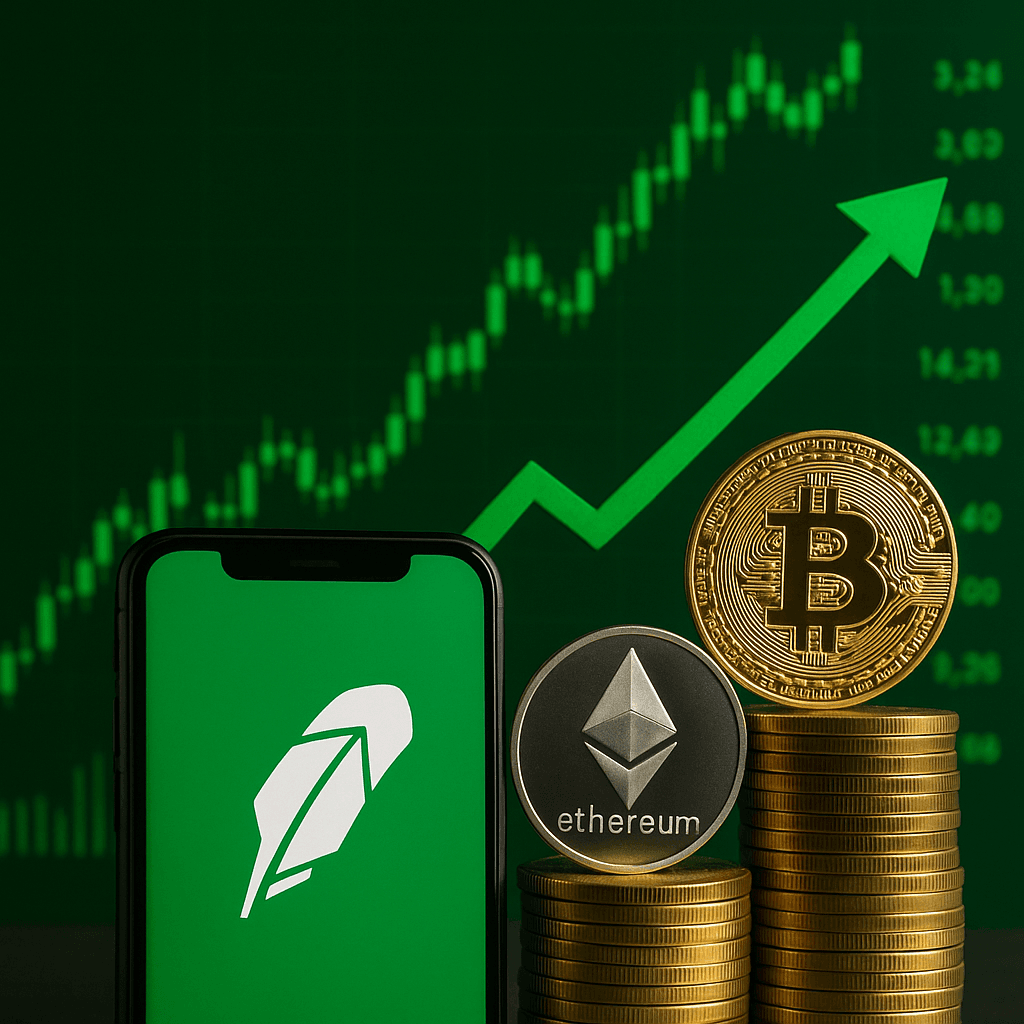

Robinhood Markets Inc. has reported a massive 217% year-over-year surge in Q3 earnings, driven primarily by a sharp increase in crypto trading volumes and growing demand from retail investors. The fintech company’s total revenue soared to $1.2 billion, marking one of its strongest quarters since going public.

Crypto Trading Fuels Record Quarter

According to the company’s financial disclosure, crypto trading revenue tripled compared to the same period last year, underscoring renewed retail interest in digital assets amid the ongoing market recovery.

Robinhood’s CEO, Vlad Tenev, credited the company’s growth to expanding crypto offerings and new product integrations. “We’re seeing a surge in user engagement across both traditional and digital assets. Our focus remains on giving people greater access to the financial markets,” Tenev said.

The exchange’s growing crypto portfolio — including Bitcoin, Ethereum, and Solana — has been a key contributor to its resurgence, as investors diversify beyond equities and ETFs.

Retail Resurgence and Strategic Expansion

Robinhood also recorded a notable increase in monthly active users and average account balances, reflecting rising confidence among retail traders after a year of subdued activity.

Beyond trading, the company continues to expand into debit cards, savings products, and international markets, with recent launches in the U.K. and EU aimed at widening its user base. The platform’s expansion strategy suggests a long-term pivot toward becoming a comprehensive financial ecosystem, blending fintech innovation with crypto adoption.

Market Analysts Turn Bullish

Analysts have responded positively to Robinhood’s results, with several upgrading their outlooks. Many cite crypto trading growth as a sustainable driver of future earnings if market volatility persists. However, others caution that regulatory scrutiny in both the U.S. and Europe could pose challenges to Robinhood’s expansion plans.

Still, the company’s diversified revenue streams and strong Q3 performance signal resilient growth in a competitive fintech landscape.

Conclusion

Robinhood’s Q3 earnings report highlights the company’s remarkable turnaround, fueled by crypto adoption, user growth, and strategic expansion. As the fintech firm cements its position at the intersection of traditional finance and digital assets, all eyes are on how it sustains momentum through 2025.