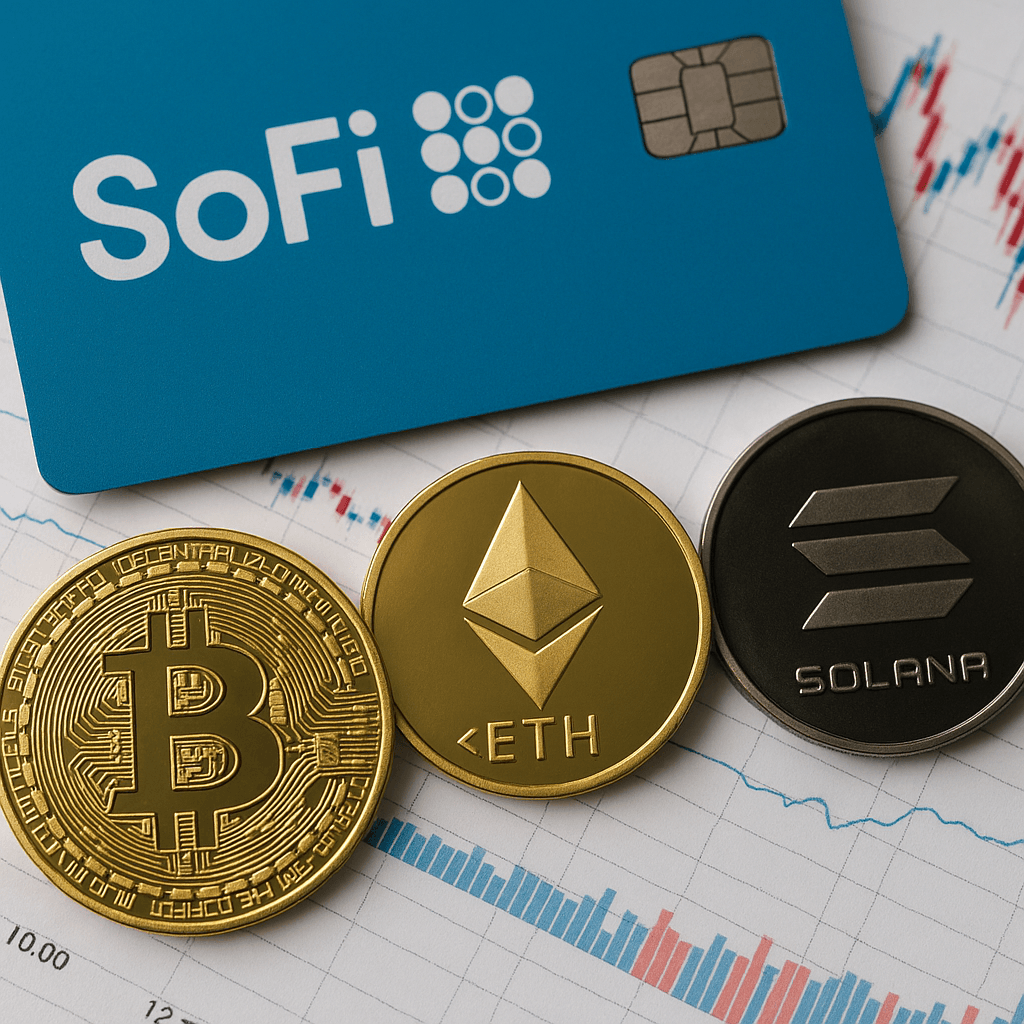

After a brief pause, SoFi Bank has officially reintroduced cryptocurrency trading for its customers, reinstating access to major digital assets including Bitcoin (BTC), Ethereum (ETH), and Solana (SOL). The move marks a renewed commitment by the U.S.-based fintech giant to offer digital asset services following a period of regulatory adjustments and internal restructuring.

Regulatory Pause and Relaunch Strategy

SoFi initially paused its crypto operations earlier this year amid tightening U.S. regulatory scrutiny and the need to align its services with evolving federal banking standards. The decision followed increased oversight by the Federal Reserve and the Office of the Comptroller of the Currency (OCC), prompting many traditional financial institutions to reassess their crypto offerings.

The recent relaunch, however, suggests that SoFi has completed the necessary compliance updates, ensuring its crypto trading service operates in full regulatory alignment. This return positions SoFi among the few U.S. banks actively re-engaging in crypto services despite a cautious market environment.

Renewed Access to Leading Assets

Under the new rollout, SoFi customers can once again buy, sell, and hold leading cryptocurrencies such as Bitcoin, Ethereum, and Solana directly through the bank’s platform. While the service currently focuses on these major assets, SoFi has hinted at plans to expand its list of supported tokens in the near future.

A SoFi spokesperson highlighted that the relaunch reflects the company’s goal to “empower customers with secure, transparent access to digital assets” while prioritizing education and responsible investing. The bank’s platform integrates built-in risk disclaimers and real-time price tracking tools to help users make informed decisions.

A Strategic Step Toward Fintech-Crypto Convergence

Industry analysts view SoFi’s move as a potential turning point for traditional financial institutions cautiously re-entering the crypto space. The bank’s renewed crypto push could inspire similar action from other regulated fintech firms seeking to balance compliance with innovation.

As mainstream adoption of digital assets grows, SoFi’s model may serve as a blueprint for how regulated banks can safely and effectively integrate crypto services into their portfolios.

Conclusion

SoFi Bank’s crypto relaunch marks a significant milestone in bridging traditional banking and decentralized finance. By reinstating BTC, ETH, and SOL trading, the bank signals renewed confidence in crypto’s future — and a growing willingness among institutions to adapt in a changing financial landscape.