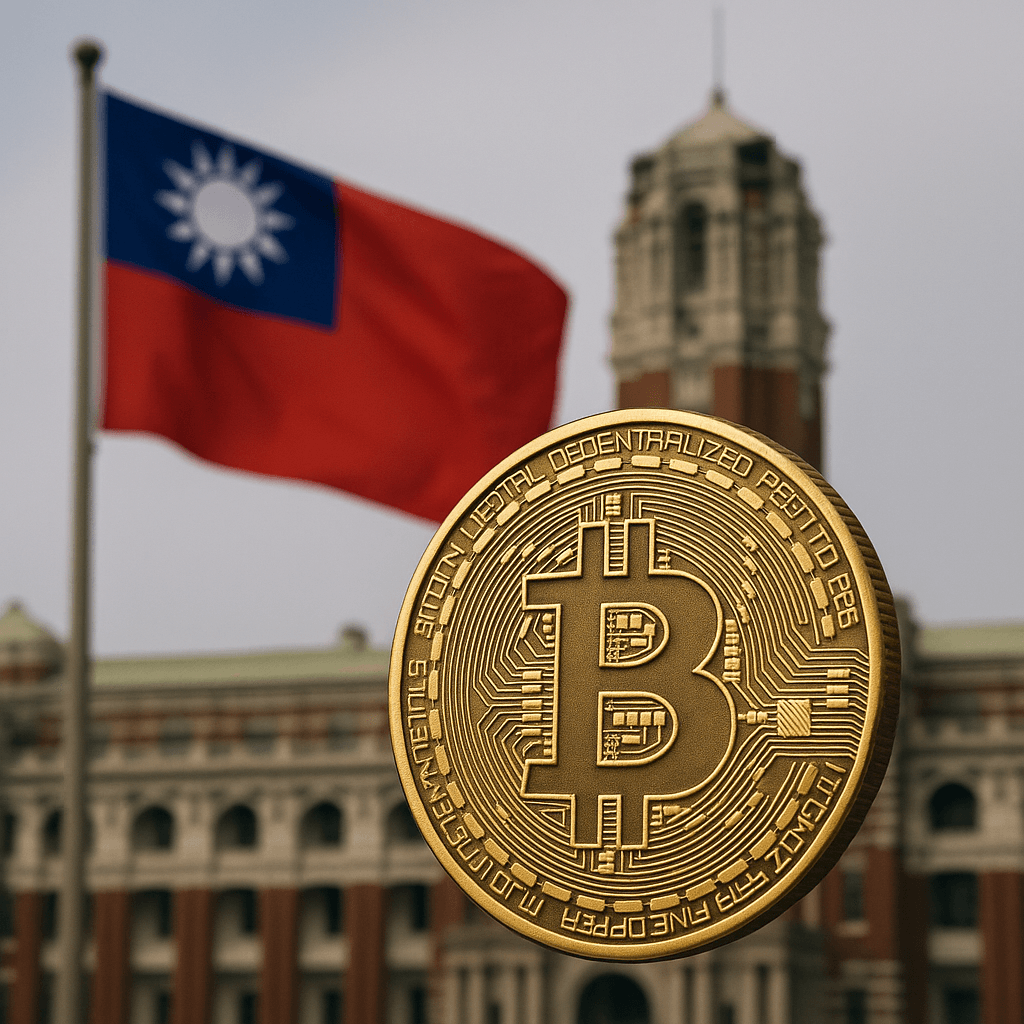

Taiwan is taking a bold step toward evaluating whether Bitcoin could play a strategic role in its national financial reserves, with officials confirming that a comprehensive report will be published by the end of 2025. The move places Taiwan among a growing number of nations exploring Bitcoin as a hedge against global economic uncertainty and geopolitical risks.

A Strategic Study on Digital Reserve Assets

Taiwan’s Ministry of Finance and Central Bank have reportedly collaborated on a long-term study aimed at analyzing how Bitcoin and other digital assets could integrate into national reserve strategies. The report will assess volatility, liquidity, cybersecurity requirements, regulatory frameworks, and the geopolitical implications of holding Bitcoin at a state level.

Officials emphasize that the study does not guarantee adoption, but it reflects Taiwan’s interest in diversifying reserve assets amid shifting global monetary trends. With inflation pressures and concerns about U.S. dollar concentration, several governments have begun reassessing reserve management — and Taiwan appears ready to join the conversation.

Growing Global Interest in State-Level Bitcoin Strategies

If Taiwan proceeds with a Bitcoin reserve strategy, it would join a small but influential group of countries experimenting with state-held Bitcoin, including El Salvador and several emerging markets using BTC to attract investment or stabilize remittance flows.

Analysts note that Taiwan’s interest is particularly significant due to its role as a global semiconductor hub and a key player in the Asia-Pacific economy. A national Bitcoin adoption study from such a technologically advanced economy could influence conversations across Japan, South Korea, Singapore, and the wider region.

What This Means for Markets and the Web3 Sector

The announcement has already gained attention in global crypto markets, with traders speculating that Taiwan’s involvement could boost institutional confidence in Bitcoin.

For the Web3 community, a national-level study signals growing legitimacy for digital assets as macroeconomic tools. It may also encourage innovation-friendly policies in Taiwan’s blockchain sector, potentially expanding its role as a regional Web3 development hub.

Conclusion

While Taiwan is far from formally adopting Bitcoin as a reserve asset, the commitment to publishing a detailed study by 2025 marks a meaningful shift in how nations evaluate digital currencies. The findings could shape not only Taiwan’s financial strategy but also broader global discussions about Bitcoin’s place in the future of sovereign reserves.